What is the Value of CuBit™

Crypto Value

The value of real estate is what backs the value of CuBit™. Real estate related instruments and direct real estate ownership held by Universal Real Estate Wealth Protection Solutions, LLC™ (UREWPS™, the Company) qualify as real estate. At startup, the reserve ratio of CuBit™ to real estate to CuBit™ will be low. The Company will move quickly to achieve its target ratio of 65%. This ratio means that the value of real estate held by the Company will meet or exceed the value of 65% of all issued CuBit™.

The early disparity of the reserve ratio is because at inception the Company held no real estate. As we mint and sell CuBit™, we convert about 65% of that wealth into real estate held by the Company. Expert opinions by real estate investors are that, depending on the cash involved, it will take 1 to 4 months to convert cash into closed deals. The Company is targeting 12 months or more. The actual time needed depends largely upon the amount of revenue from your purchases of CuBit™.

Why We Chose 65%

We have chosen the 65% reserve threshold based on commercial lending practices. These have proven to be generally sufficient for lenders to protect their equity and preserve their liquidity in the face of economic downturns.

Most commercial lenders will only lend up to 65% of the value of real estate (LTV = Loan to Value). In the event of foreclosure this allows them to use the forfeited owner’s equity to pay for the costs of foreclosure and liquidation while recouping the principal of the loan.

There is no LTV for CuBit™. We do not lend money. We are an equity partner with seasoned real estate investors. The 65% ratio represents the target exchange rate between CuBit™ and real estate. Therefore, if a CuBit™ were converted to $100 USD, the Company would sell $65 USD worth of real estate in a liquidation event. The $35 remaining would come from liquid assets in the CuBitDAO™ Asset Ledger. If you want your money back, you do not care if it comes from real estate or liquid assets.

When you want to protect your wealth from inflation and volatility the amount of real estate involved is particularly important.

Backing CuBit™ with a ratio of 65% real estate and 35% liquid assets allows the company to maintain adequate liquidity levels. Liquid assets also fund ongoing operations and take advantage of market opportunities.

Beating Inflation

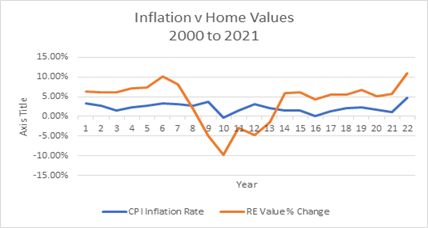

As CuBit™ is backed by the value of real estate and it tends to be a deflationary currency. This means that the buying power of each CuBit™ tends to increase at a rate that is faster than inflation. The graph below (see Figure 1 Inflation v Home Values 2000 to 2021.) shows how the median home value in the USA has changed from 2000 to 2021. It also shows how inflation has changed during this same time. The changes have been normalized to percentage value changes. This comparison shows how real estate values usually outpace inflation. This means the buying power of wealth invested in real estate tends to be protected against inflation.

Over this total period the average rate of inflation was 2.2% while home values increased 3.9%. This includes the significant decline in home values in 2008 through 2012. This trend is consistent even when measured over longer periods of time. We included 2012 through 2018 to emphasize the effects of unexpected declines in home values. Overall, real estate is a resilient hedge against inflation. It bounces back from unusually adverse conditions.

Above Reflects

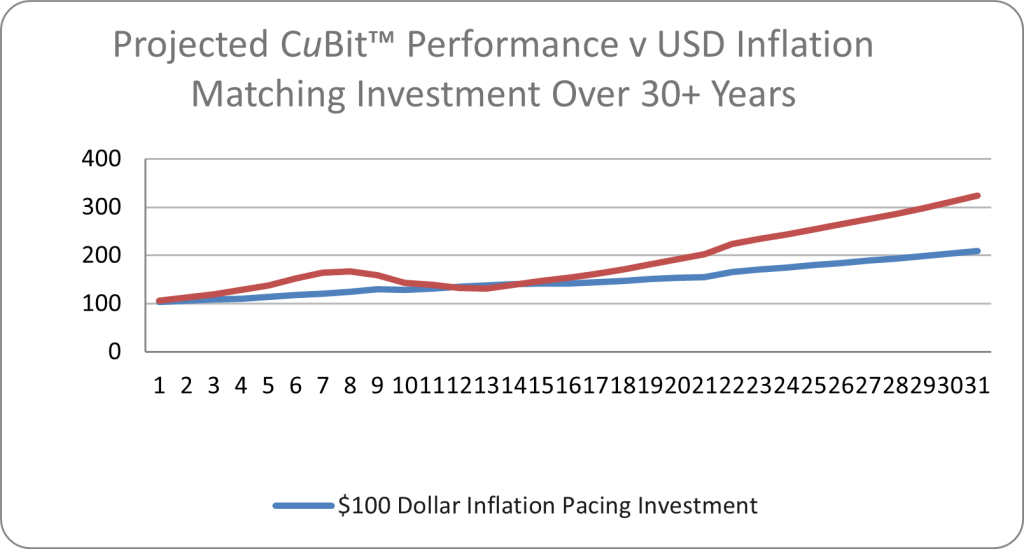

Figure 2 uses this same underlying data to show the respective value over time of $100 USD invested in a hypothetical inflation-pacing security versus $100 USD deposited in CuBit™. The chart uses retroactive information from the past 20 years (the same time frame used in Figure 2 – Inflation Pacing Investment vs CuBit™). Further, it assumes that you could have bought CuBit™ 20 years ago, and that an inflation-pacing security exists for your $100 USD investment.

The graph uses the rate of inflation to adjust the value of the USD and uses the change in home values to adjust the value of the CuBit™ and it uses the same base period of 2000 to 2021. For years beyond 2021, the graph assumes the average inflation rate of 2.2% and the average appreciation rate for homes of 3.9% both continue unchanged.

Inflation Pacing

During the massive value decline in real estate from 2008 to 2012 CuBit™ would have fallen below the value of your inflation-pacer. However, just two years after the nadir, your CuBit™ would be worth more than the inflation-pacer. By 2021, your inflation-pacing $100 investment would have been worth $162. That is not bad. However, your $100 CuBit™ investment would be worth $209.

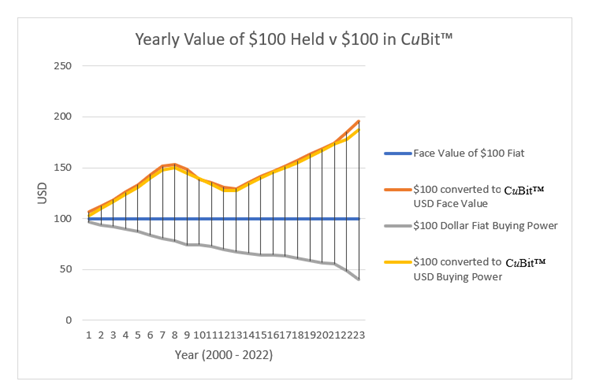

In Figure 3 (below) we compare the declining buying power of USD due to inflation against the appreciating value of a CuBit™. The value proposition of CuBit™ is even more dramatic when inflation is allowed to take its toll. Please realize that Crypto Value is typically speculatory, and volatile, where CuBit™ is not.

In this scenario we updated to use the 22-year averages for inflation of the USD and appreciation of real estate. Applying real estate appreciation to CuBit™, and inflation to USD, respectively. By year 2 the buying power $100 USD declines to $94 while the buying power of $100 USD of CuBit™ will have increased to $110. Every year after that the gap in buying power continues to widen until by year 10 today’s $100 USD is worth only $74 USD today. At the same point the $100 USD of CuBit™ will have the buying power of $139 USD today. When we reach the end of year 22, we find the $100 USD has degraded to just $40 worth of buying power: a decline of 60%. In contrast, $100 of CuBit™ has a face value of $196 and the inflation-adjusted buying power of $187, a difference of more than 465% over the USD buying power.

CuBit™ incorporates inherent protections against volatility and Universal Real Estate Wealth Protection Solutions, LLC™ (UREWPS™, the Company) is committed to supporting the asset-based valuation of CuBit™. As with any currency there is nothing to prevent speculators from taking unforeseen actions which might cause the price of CuBit™ to vary without reference to the underlying value proposition. The Company cannot prevent and is not responsible for the actions or results of such speculative behaviors.

It’s an remarkable article designed for all the online visitors;

they will get advantage from it I am sure.

Thanks for the praise.

I’m really impressed with your writing skills and also with the layout for your blog.

Is this a paid topic or did you modify it yourself? Either

way stay up the nice high quality writing, it’s uncommon to peer a

great weblog like this one today..

Glad you liked it. Did it ourselves, without ghost writers.

When I initially commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment

is added I get four emails with the same comment.

Is there any way you can remove me from that service? Thanks a lot!

I wasn’t aware it did that. I am sorry about that. I will hand this off to my tech support folks to see what they can do to fix this. I definitely would not like to be on the receiving end of this either. Again, my apologies.

Test comment

Testing right back at you.

I’m not sure why but this weblog is loading extremely slow for me.

Is anyone else having this issue or is it a issue on my end?

I’ll check back later on and see if the problem still exists.

Let us know if the slow loading continues to be a problem.

This post is transformative! Speaking of transformation, xxxxxxxxxx transforms art.

Glad you like the post. Sorry, no advertising allowed in comments.

Ahaa, its good discussion on the topic of this post at this place at

this web site, I have read all that, so at this time me also commenting at this place.

Glad you liked it. Sorry. No links allowed in comments.

My brother suggested I might like this blog. He used to be entirely right.

This submit actually made my day. You cann’t imagine

simply how much time I had spent for this information! Thank you!

Glad you liked it. Be sure to spread the word.

Spot on with this write-up, I really feel this web site needs far more attention. I’ll probably be

returning to read more, thanks for the advice!

Glad you liked it. Be sure to spread the word.