Minting more CuBit™ won’t inflate the currency for one simple reason; more CuBit™ leads directly to more real estate purchases backing its value.

The foundation of a stable currency is a balance between the currency available and the goods and services available to back that currency.

Declining Buying Power

Gross domestic product (GDP) is the accepted measure of goods and services in our economy. Stable prices occur when the money supply matches GDP.

Inflation results when more money is chasing the same amount of goods and services. Unleashing a flood of money makes each dollar worth less than it was before the flood. The inherent value or quantity of the goods and services available have not changed. When the Federal Reserve injects more money into the economy through what they call “Quantitative Easing” inflation is inevitable. Adding cash into the economy without adding goods and services decreases individual and collective buying power. The buying power of each dollar decreases and prices go up, requiring you to spend more dollars to buy the same goods and services.

Inflation is a decrease in buying power. Cutting away all the confusing jargon from monetary theorists, this is the real-world definition.

Out of Control

The Federal Reserve appears to enjoy the freedom to adjust the supply of US Dollars (USD) at their whim. Only the people who hold CuBit™ control its supply, not politicians, not unelected bureaucrats and not international bankers. The single most important lever controlling the value of the currency is the supply. We refer to the members holding CuBit™ as the CuBitDAO™ (Decentralized Autonomous Organization or DAO). Nothing could be more democratic than having the people who depend most on the value of each CuBit™ holding the most important lever controlling the value of their currency, the supply.

Inflation Concern for CuBit™

In the Autumn of 2022, when CoinScope (aka CyberScope) audited CuBit™ (then called by the working name DirtiCoin™), CoinScope noted a “Critical” concern. Minting more CuBit™ could cause inflation, (devaluing) CuBit™. This is a valid concern for all fiat currencies and for all currencies whose value is not backed by a commodity. Minting more CuBit™ won’t inflate the currency because the amount of available currency is directly related to the amount of the available commodity. The contract to manage the assets of the CuBitDAO™ requires the manager to maintain the ratio of commodity to currency within predefined limits. As more CuBit™ is minted more real estate is purchased.

Commodity Currencies Are Deflationary

Minting more CuBit™ won’t inflate the currency because CuBit™ is a commodity-backed currency. From 50% to 80% of its value is backed by real estate reserves. The target state is 65% real estate. Liquid assets back the remainder of the value. Monthly updates to the CuBitDAO™ Asset Ledger (the Ledger) demonstrate the reality of these facts.

Minting more CuBit™ spurs acquiring more real estate. The unending cycle of buying and selling real estate means there is no theoretical upward boundary on the amount of real estate available to back CuBit™. Meaning, it could theoretically continue to expand its supply of CuBit™ forever, if there are sufficient real estate deals to sustain its value.

Owner Controlled Monetary Supply

Brutal realities often mug beautiful theories. An unending supply of real estate deals is a beautiful theory. When the beautiful theory gets mugged, the DAO “burns” CuBit™ to reduce the monetary supply. CuBit™ is redeemed from the market and burned by the DAO. Reducing the supply increases the value of the remaining currency. When the Federal Reserve does this, they call it “tightening.”

When burning is required, the DAO will order the DAO manager to buy back CuBit™ from depositors at current market prices. The manager will then burn the redeemed CuBit™.

Value Gains for CuBit™

Minting more CuBit™ won’t inflate the currency because the value of each CuBit™ is growing. We buy distressed and undervalued properties, which dramatically increases the value of CuBit™. Buying distressed and undervalued real estate is a primary acquisition strategy to build the CuBit™ real estate portfolio. Purchasing properties at no more than 70% of their full market value is a key metric of success. The 70% acquisition cost includes all expenses needed to acquire the property and bring it up to conditions where its sale can command full market value.

In gross numbers, this means that the 70% threshold will generate a full return of the 70% invested, plus a return above the amount invested of more than 42% (42.871%). While the CuBit™ model uses partnerships with local affiliates and real estate investors, it may not accrue the full 48% for CuBit™. Rough analysis puts the CuBit™ gain at about 14% (0.142857) of the amount invested.

Growing CuBit™

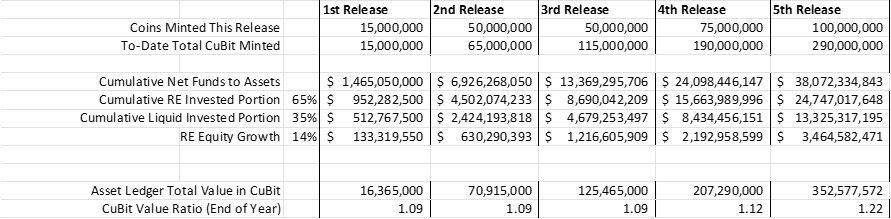

In Table 1, we reference the first five planned releases of CuBit™. All numbers are shown in terms of CuBit™ unless otherwise marked with US dollar signs.

You can see that the target ratios of 35% liquid assets and 65% real estate assets control the use of all the available CuBit™. The 14% return on investment, mentioned above, is shown as “RE Equity Growth.” Asset Ledger Total Value is the sum of RE Equity Growth, RE Invested, and Liquid Assets. The Asset Ledger Total Value backs the value of CuBit™.

This projection is inflation neutral relative to the US Dollar. It also does consider how inflation of the US Dollar will drive up the value of real estate over this same time interval.

The CuBit™ Value Ratio (End of Year), shown in the last row of the table is the result of dividing the Asset Ledger Total Value by the To Date Total CuBit Minted to reveal the natural value of each CuBit™ relative to its original value when minted.

Table 1 Five Planned CuBit™ Releases

Stable CuBit™ Values

Maintaining the asset ratios in the Ledger while the supply of CuBit™ increases keeps the CuBit™ Value Ratio stable above the 1 CuBit™ level. This makes CuBit™ the most stable currency in the world. Minting more CuBit™ won’t inflate the currency because the required asset ratios prevent leveraging.

Value Growth for CuBit™

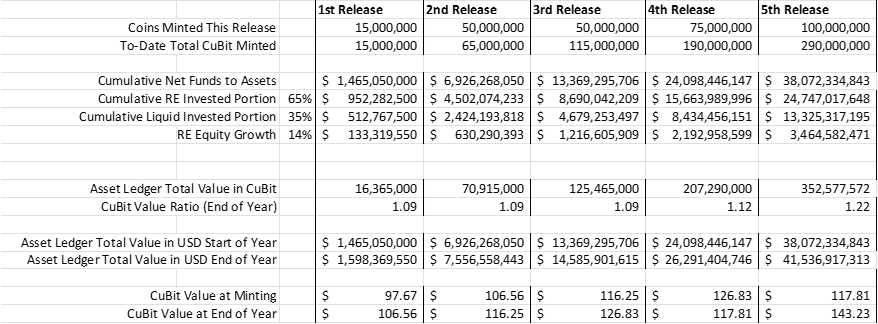

Table 1 clearly demonstrates the lack of inflationary effects from minting additional CuBit™ while maintaining target investment ratios. However, it fails to answer the question of how this relates to the US Dollar value of their wealth. Table 2 expands upon Table 1demonstrating how this affects the buying power of your CuBit™ in terms of US Dollars.

In Table 2, we add the natural value increase of 9% to the value of the CuBit™ at minting. The 1st Release uses the Value at Minting of $97.67. Fully deploying the release using the target ratios the value rises 9% giving the Value at End of Year of $106.56. This becomes the baseline value per CuBit™ for the 2nd Release.

Fully deploying the 2nd Release at the target ratios, the natural value per CuBit™ becomes $116.25. This becomes the baseline value for the 3rd Release. And so on until fully deploying the 5th Release makes a single CuBit™ worth $143.23. For every CuBit™ in the 1st Release, bought at $97.67, that is an increase in value of more than 46%. That is an average natural value increase of more than 9% per year.

Table 2 CuBit™ Release Impacts on Changing the USD Value of CuBit™

Real Estate Appreciation

Minting more CuBit™ won’t inflate the currency because the projected gains of CuBit™ are based wholly on the appreciating value of real estate without regard to the effects of US Dollar inflation on the relative value of real estate.

Throughout most of U.S. history the value of real estate has increased at a rate that exceeds inflation of the US Dollar. During 2021 and 2022 real estate values shot up, then began to drop as interest rates on mortgages went up.

Conclusion

A 2022 report in Forbes says that median housing prices in August of 2022 were 8% higher than they were in August of 2021. To be fair, that just about matches the inflation rate for the same period, meaning that the real values have remained flat and have only been increased by inflation. However, for someone holding CuBit™ during this same period it means that the value of their CuBit™ increased 9% from the natural appreciation of the real estate and another 8% because of the inflated value of the US Dollar, for a total increase of 17%. This is why we say that CuBit™ protects you from inflation.

To protect your wealth from volatility and inflation you should move as much of your stored wealth as you can into CuBit™, as quickly as possible, and keep it there as long as you can.

Although the design of CuBit™ incorporates inherent protections against volatility and Universal Real Estate Wealth Protection Solutions, LLC™ (UREWPS™, the Company) is committed to support the asset-based valuation of CuBit™, as with any currency there is nothing to prevent speculators from taking unforeseen actions which might cause the price of CuBit™ to vary without reference to the underlying value proposition. The Company cannot prevent and is not responsible for the actions or results of such speculative behaviors.

xxx2

Thanks for your insightful remark. LOL