Tokenomics and CuBit™

From the Desk of Sudato M. O’Benshee

A White Paper from

Universal Real Estate Wealth Protection Solutions™, LLC

Most graphics used in this paper under license with DepositPhotos.com. Other graphics are original art and copyrighted by the publisher UREWPS™, LLC (c) 2024 All Rights Reserved.

“From the time my team first envisioned the Universal Real Estate Stable Coin™ (URESCu™, CuBit™) we have been asked by cryptocurrency experts, “What are the tokenomics of URESCu ™?” As a newcomer to the world of crypto I had no idea what tokenomics meant, so I asked.

“They defined tokenomics for me (Angel One, 2023) often using examples of other crypto offerings, past and present. As I learned what they meant, I was surprised to realize something.”

The simple fact is that “there is nothing new under the sun.” (Ecclesiastes, The Holy Bible). Although blockchain is new, what people are doing with it is not.

Tokenomics is a cryptocurrency buzzword describing a well-established process for rolling out stock offerings for business ventures. Often, these are referred to as an Initial Public Offering (IPO). Some wording is changed to adapt the concepts for the cryptocurrency world, but the essentials match. This is why the term Initial Coin Offering (ICO) was previously applied to crypto rollouts.

Being familiar with the IPO process for many years now, I am admittedly not a fan of certain features. An IPO frequently involves significantly greater returns for those who invest earlier in the process and lower returns for those who invest later in the process. That doesn’t bother me because I understand the notion of risks and rewards. However, in the late stages of an IPO there is some rapacious profit-taking by the broker dealers controlling access to the public although they have taken on very little risk.

Initially, the crypto world embraced the term ICO. However, participants soon realized that a too-close association with practices used to roll out stock offerings would facilitate the efforts of regulators to establish that an ICO and an IPO are essentially the same thing and should be subject to all the same regulations. Consequently, the term ICO has fallen out of general favor.

Type of Offering | Explanation | Regulated? |

Initial Public Offering (IPO) | In essence, an IPO means that a company’s ownership is transitioning from private ownership to public ownership (Fidelity Learning Center, 2023). Stock in a business is offered to the public through licensed broker dealers. Often, the value of the stock offering is determined (underwritten) by a reputable financial institution to determine the price point to be offered initially for each share. The IPO may be followed later by “Follow-on” offerings and “Secondary” offerings. These involve additional, new shares or sales of large blocks of shares by investors. | Yes |

Initial Coin Offering (ICO) | Investors buy into an initial coin offering to receive a new cryptocurrency token issued by the company. This token may have some utility related to the product or service that the company is offering, or it may just represent a stake in the company or project. (EMBroker.com, 2022) | Sometimes |

An IEO (Initial Exchange Offering) is like an ICO in that it is launched on a centralized exchange and promises that the token will be listed on an exchange and investors will not be duped. Furthermore, in IEOs, crypto projects are scrutinized, and the roadblock for projects participating in an IEO is relatively high. (LCX Team, 2022) | No | |

An Initial DEX Offering, or IDO for short, enables cryptocurrency projects to introduce their native token or coin through decentralized exchanges (DEXs). … Tokens in an IDO are immediately listed on the DEX via which they are launched. This means that project developers are no longer required to gather assets for pools; instead, the pool is formed on a DEX after the IDO is completed via its own or a third-party launchpad. (LCX Team, 2022) | No | |

Security Token Offering (STO) | Security token offerings distribute securities or tokens that are fungible, negotiable financial instruments with attached monetary value. Security tokens are not traded on regular token exchanges and do trade on specialized exchanges. (EMBroker.com, 2022) | Limited |

Regardless of the mechanism used to offer a cryptocurrency to the public, initially or otherwise, the timing when such offers arise coincides with key points in the life cycle of a venture.

Nothing New Under the Sun

All startup businesses, including crypto ventures (called projects), go through essentially the same economic process. Startups.com (McGowan, 2017) names them:

Early stage

Seed stage

Growth and establishment

Maturity

Acquisition

Tokenomics explicitly integrates economic dynamics with the business development efforts for each stage of the process. I must give credit, there doesn’t appear to be a single word for this process on the stock markets’ side of business. Tokenomics is an elegant word for this process as it relates specifically to the funding and development of cryptocurrencies and other digital tokens.

Business Life Cycle Stages

1. Early Stage

The earliest business stage is the idea. One or more people develop the idea into a product and build plans for a business to create and sell that product. Usually, this early stage is funded by the individuals involved. These are the Founders. They often do the work in their spare time, investing their intellectual capital and their own modest financial capital.

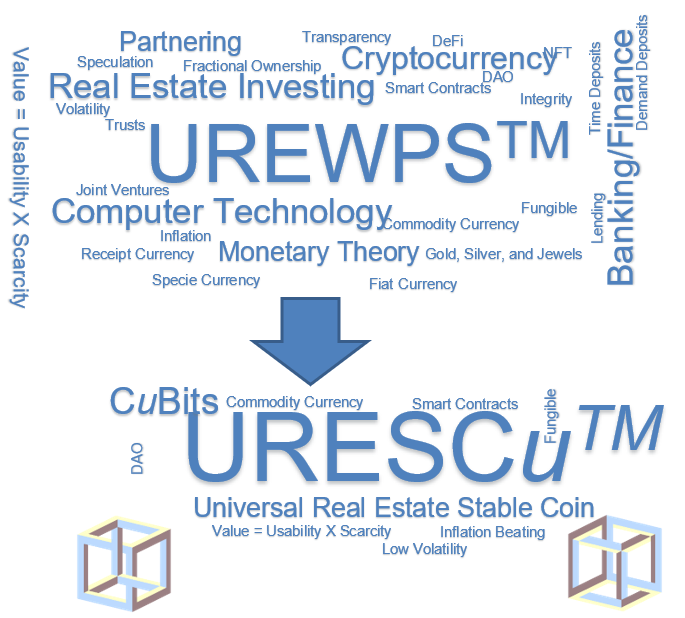

The URESCu™ Idea

For CuBit™ the idea is to create a currency that allows savers to protect their money from inflation caused by the manipulation of central banks and politicians while also shielding it from overt theft of speculative volatility.

Real Estate for the Wealthy

Investing in real estate is how the wealthy have done this. Unfortunately, even when real estate investing is within the means of many people, doing it successfully requires a sophisticated level of knowledge and risk management. Many unscrupulous individuals and organizations understand this and dedicate substantial efforts to trade risky and speculative real estate investing techniques for the very money people are trying to protect and nurture.

Real Estate for Ordinary People

Real estate investment trusts (REITs), mortgage-backed securities (MBS), and other financial innovations attempt to benefit the small investor by pooling their money and partnering with real estate professionals to acquire and manage a portfolio of real estate.

Blockchains and DAOs

The use of blockchain technology and decentralized autonomous organizations (DAO) allows for the creation of a monetary system in which the people who hold the money in their hands have direct control of the factors which inflate their currency.

A Perfect Combination

CuBit™ combines these two ideas in a unique way to create a truly fungible currency controlled by those who hold it while giving them key benefits from real estate investing.

At the same time, CuBit™ provides a means for those who are willing to learn the “how” to successfully invest in real estate to learn and succeed even when they don’t have the massive amounts of money typically needed to make real estate deals work effectively.

Meeting the Needs of Multiple Markets

In short, the idea behind CuBit™ is to bring together two groups of people with complementary needs.

Savers need to keep their money growing faster than inflation can eat it up without hurling themselves into the devastating maelstrom of speculative investments. Real estate investors need reliable access to large amounts of money to acquire, repair, and operate profitable real estate investments.

The Company Making it Happen

Universal Real Estate Wealth Protection Solutions, LLC™ (the Company or UREWPS™) has assembled a team of individuals with significant experience in finance, real estate investing, and computer technology. The result is CuBit™. The world’s first, fully fungible currency backed by the value of real estate.

Divine Intervention

2. Seed Stage

After the idea forms, it becomes a seed needing water, soil, and fertilizer to grow. The water, soil, and fertilizer consist of money together with a group of people dedicated to nurturing the idea and transforming it into reality. Money is needed to keep the team members alive and allow them to focus on growing the seed.

Most of these teams have lots of energy and intelligence, and very little money. It seems like they need divine intervention to get the money needed to transition the seed into a real product.

This allusion to divine help is why those who invest in such startup ventures are typically called “Angel Investors.” Angel Investors provide the team with “seed capital.”

Angel Investors

Angel Investors are often high net worth individuals who have money they are willing to risk on the chance that they will fund a winner. They are speculators and often have been successful entrepreneurs themselves. Because many ideas never fully develop into viable products, Angel Investors lose money more often than they find a winner. Theirs is a high-risk endeavor. However, when they find a winner, it more than pays them back for all the previously failed ideas where they lost money. They typically aim for returns that are 10 to 15 times what they invested. They usually want to recoup this within one to five years. In exchange for their investment of seed capital, Angel Investors usually receive an ownership stake in the company in the form of shares.

The Minimum Viable Product (MVP)

Seed capital is typically needed to make the seed grow and bloom into a minimum viable product (MVP). The MVP is usually just enough of the idea made reality to demonstrate its true market potential.

Ideally, during the seed stage, the MVP is fully tested and validated to ensure it will deliver the expected benefits or performance. Some prototypes, or “Beta” versions are created and sold so a customer base begins to form and the viability of the product both functionally and economically is demonstrated.

Seed Funding for CuBit™

Founders of the Company provided the seed funding to transform CuBit™ from an idea, into a seed, and an MVP. CuBit™ is a very tiny sprout, just emerging from the soil. Soon it will grow into a tree delivering fruit year after year to those who take part in its growth.

Traditional Business

In the business world, when the venture begins the Founders own all the shares of the company. Angel Investors trade their investment capital for shares in the venture, given up by the Founders.

Tokens

Crypto Business

In the crypto world projects often have three kinds of “tokens” used for a variety of purposes in the life of the project. Token is a crypto term referring to some form of smart contract. Tokens representing authority to control the project are “Governance” or “Security” tokens. These are the voting shares in a business venture with dividend rights, meaning they own part of the profits (when those appear). They are non-fungible tokens (NFT), meaning they can’t be readily exchanged for each other, or for any other sort of token. The value depends entirely on the project’s value and its success.

Often there are two more types of tokens.

The most readily comprehensible token is the end product of the project. Some projects will provide select groups or individuals the opportunity to acquire these products early at prices that are significantly lower (discounted) than the intended market value of the product. As the project progresses, holders can sell them at or near market value, thus reaping substantial profits, having bought low and sold high.

Sometimes another token is provided to investors. While it has various names, it is analogous to non-voting stock in a business. This token permits the holder to collect dividends while allowing no control over the project. The value of this token goes up with the value of the whole project and with the prospect of profit sharing in the form of dividends.

Crypto Business Tokenomics

The tokens provided (or committed) to Angel Investors and Founders are often valued at a small fraction of the ultimate expected price point for these tokens.

When the project begins to succeed, the value of these tokens quickly spirals upward from fractions of a penny each to 10 or fifteen cents each. Angel Investors who sell their tokens at this stage are getting the return they hoped for.

CuBit™ Tokenomics

For CuBit™, there is only one token. It is an ERC-20 smart contract on the Ethereum Mainnet. The base denomination of URESCu™ is called a CuBit™. Often the term CuBit™ is used interchangeably with references to URESCu™. Every CuBit™ contract with a non-zero balance (negative balances aren’t possible), has proportional rights to control and returns.

At present the Company does not issue any governance tokens, instead, it wholly conforms to US Securities laws regarding ownership interests in a closely held LLC incorporated in the State of Wyoming.

By agreement between the CuBitDAO™ and UREWPS™, the Company Founders receive 10.1% of each minting of CuBit™. This endowment is immediately loaned back to the Company for unrestricted use by the Company. Because of this unrestricted loan, all minted tokens are fully available to be used in exchange for deposits from the public and for all other regular uses of CuBit™. The Company pays interest to the Founders for this loan and retires the loan incrementally as profits allow. However, no portion of the loan can be scheduled for redemption until one year after the minting. URESCu™ uses the CuBit™ as its base denomination, and the Founders’ share of the minting is held hostage to the realization of profits by the Company, the handling of the Founders’ share of the minting is governed by a Company policy known as the “Hostage CuBit™ Policy.”

CuBit™ Promotions

At present, CuBit™ promotional efforts, which might involve CuBit™, take three forms:

Commemorative or Collectible NFT with a bonus CuBit™

Information products with a bonus CuBit™

Marketing promotion bonus CuBit™ with the purchase of CuBit™

Commemorative or Collectible NFT

At various times the Company may issue commemorative tokens or collectible tokens in the form of non-fungible tokens (NFTs). These NFT are collectibles and have no bearing on the value of CuBit™ tokens or on the control of the Company.

These commemorative NFT use images and references to CuBit™. When offered for sale, they may include a free CuBit™. When that happens, the Company deducts the value of the CuBit™ from the NFT purchase price and transfers it to the CuBitDAO™ Asset Ledger (the Ledger) to prevent any value dilution for CuBit™.

Information Product Special Offers

In cooperation with select publishers, a CuBit™ may be offered as a free bonus with the purchase of certain information products. In these instances, the publisher reimburses the Company for the full price of each bonus CuBit™. The Company deposits that reimbursement into the Ledger to prevent any value dilution for CuBit™.

Marketing Special Offers

By agreement with select promoters, the Company may offer to allow anyone using specific promotion codes to receive a small bonus (1%) when transferring money into CuBit™. Financial forecasts show that this small incentive will not materially dilute the value or returns for CuBit™.

Marketing is a function of the Company, rather than the CuBitDAO™. Marketing expenses, including bonus CuBit™ are paid for by the Company. Costs do not come out of the deposits of CuBitDAO™ members.

3. Growth and Establishment

To grow the seedling and establish the venture as an ongoing concern, more money is needed. The MVP needs to put in front of many people who can use it and gain its benefits. Marketing a product takes skill and money.

Nurturing the product into something that benefits a great many people requires a great deal of money.

Enter the venture capitalists (VC). VC’s seek companies that have a proven MVP and need funding to scale up their operation so it can reach a large customer base.

Traditional Business

In the manufacturing world this means building or retooling factories employing hundreds of people. It means establishing distribution networks moving the product to market. It means you have marketing teams creating advertisements and placing them where potential customers will see them and create demand for the product. The VC takes on less risk than Angel Investors because the idea is now proven viable and has a modest customer base. However, VC are investing a lot of money to make it all happen. They too want a good return, and they want a lot of control over the company.

Crypto Business

In the crypto world, this means VC receives a lot of governance tokens and a lot of product tokens. Sometimes they get these at discounted prices below the prevailing price of 10 or fifteen cents per token.

Fast Followers and Promoters

The injection of VC capital often creates a self-fulfilling prophecy of sorts. The investment is publicized widely, and many people want to be fast followers of this “smart” money. So, they rush to buy the publicly available tokens. The demand drives up the retail prices and suddenly the tokens bought by VC at 15 cents each are worth 50 cents, or more. This allows the VC to earn 3 or 4 times their investment.

Fast Followers or Promoters are willing to pay 50 cents for each token in the belief that demand will continue to grow, and others will be willing to pay a dollar for each token, or more. This doubles the money of the fast follower.

In the crypto world the VC, Fast Followers, and private project Promoters often receive large amounts of significantly discounted tokens as part of the public release of the project. Just like the discounted stocks provided to broker-dealers in the business world, the financial stake these promoters have in the success of the token sale is not disclosed. When the tokens sell, they make huge profits.

Rogues and Pirates

Some unscrupulous VC, Fast Followers, and Promoters use various means to manipulate market values to their advantage. When token prices surge, they sell. They often follow this with manipulations designed to make the price fall. When the price falls, they buy. Then they restart the cycle with additional manipulations.

In the business world these types of unscrupulous maneuvers have been around for a long time and are illegal. Regulators watch for them and often catch the perpetrators. Currently, the crypto world has very little regulation and market manipulators abound.

However, in the business world it is legal and accepted for many of the VC and broker dealers promoting the public sale of an initial public stock offering to receive stocks at prices substantially lower than those available to the public. This mechanism means that when the broker sells the stock to a buyer, they get a commission on the sale and a substantial gain on the sale. While the commission is disclosed to the buyers, the gain is not.

4. Maturity

In Maturity, the product is in demand and money is coming in the door steadily. The benefits are being realized for the product buyers, and everyone seems happy. In Maturity, the incentives used during prior stages to attract capital are typically discontinued. Rewards, in the form of profits, flow to those who own stock in the venture.

Traditional Business

Although incentives to attract capital tend to be discontinued during Maturity in the traditional business world, there are still many situations where a venture continues to offer discounts on its stock to select audiences.

Most stock ownership programs offered to employees of a venture feature a modest price discount below compared to what the public pays.

Options to purchase stock at a discount and outright stock awards are often important elements of compensation packages for key employees, executives, and corporate board members.

Crypto Business

As in the traditional business world, Crypto Business tokenomics may continue to play a part in the structure and capital flow of a token.

For CuBit™ there are two pieces that remain tied to the token. The first is the Founders’ Minting Share which persists with each minting of additional tokens. The second is a “tax” clause embedded in the CuBit™ contract.

The Founders’ Minting Share was discussed previously when we discussed the Hostage CuBit™.

The embedded tax is currently set at 0.24% (0.0024). It is limited to a maximum value of 2%. Its value can only be changed by a vote of the CuBitDAO™. In operation, this tax would transfer a portion of CuBit™ to the Company whenever the token is exchanged. The purpose of this tax is to give the CuBitDAO™ opportunity to elect to fund special initiatives they may deem worthy.

5. Acquisition

Acquisition is the Shangri La for many Founders, Angel Investors, and VC. At this stage, they sell their shares in the venture, turn over the running of the company to others, and leave the company to pursue their personal bliss. Many go on to become Angel Investors, VC, or Fast Followers.

In truth, many entrepreneurs’ cash-out early in Maturity, or even during Growth. Often, they move on because the traits and skills which make them successful at starting a business are not the same ones needed to sustain and grow a business.

Price to Earnings Tell the Tale

By the time a company’s stock goes public it will often take years of dividends for the ordinary investor to get back more money than they invested.

In fact, that is the entire basis of the Price to Earnings Ratio (P/E) used to evaluate and compare stock offerings (Charles Schwab, 2021). A P/E of 15 means that it will take you fifteen years of dividends to pay back the current price per share.

The CuBit™ Difference

The tokenomics of CuBit™ aren’t new (in the history of the world), but they are dramatically different than other cryptocurrencies. The tokenomics of CuBit™ are based on one simple fact. It is a currency. To offer it at a discount is like offering to sell a $100 bill for just $20. You know that has got to be a bogus bill. Can anyone imagine the Federal Reserve offering to sell $100 bills to banks or individuals at a discount? It doesn’t happen and it won’t happen.

Universal Real Estate Wealth Protection Solutions, LLC™ (UREWPS™, the Company) is the company that created CuBit™. If deals or discounts are needed to help CuBit™ take root, they will be handled as bonuses, not discounts. Bonuses will be paid from UREWPS™ profits, not from the value of CuBit™. CuBit™ bonuses are like toasters banks used to offer as enticements to open a savings account; they won’t dilute the value of CuBit™.

URESCu™ is Legitimate

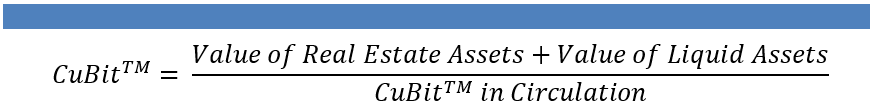

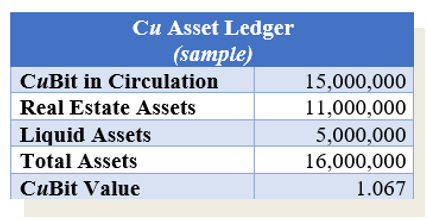

CuBit™ is a legitimate currency. Its value is backed by real estate. It is not a token whose value is driven by speculation or impenetrable algorithms. The CuBitDAO™ Asset Ledger allows everyone to see and calculate the true value of CuBit™ with one simple formula:

The values of real estate assets and liquid assets are updated monthly. CuBits™ in circulation is only changed when new CuBit™ is minted, by authorization of CuBitDAO™ members.

Good News and Bad

The good news is that when you deposit your wealth into CuBit™, you won’t lose value due to discounts given to insiders or other special interests.

The bad news is that a deposit of a modest amount (or any amount) of your wealth into CuBit™ will take time to grow substantially. The projected annual growth rate of CuBit™, based on historical real estate appreciation, is from 2% to 4% above the rate of inflation.

Speculators Beware

CuBit™ is designed to keep your wealth safe from both inflation and volatility. As mentioned previously, its value is easy to calculate without the use of fancy tools or obscure formulas. It uses real estate to achieve stability and outpace inflation. That means the value of CuBit™ will go up over time along with the value of real estate. This linkage with real estate retains and increases the buying power of your wealth. However, low volatility means it is unlikely to ever experience sudden, dramatic increases or decreases in value.

Conclusion

Although there is nothing new under the sun, CuBit™ is different from all other so-called cryptocurrencies. It is a true currency. Most cryptocurrencies in all major respects imitate stock offerings and are more akin to penny stocks or baseball cards than anything truly new.

For anyone needing to keep their wealth safe from the ravages of inflation and volatility, CuBit™ will become the preferred option for most of the world. Regardless of whether you have a little wealth, or a lot, CuBit™ is there for you.

References

Angel One. (2023, January 6). What is Tokenomics Explained: Tokenomics 101. Retrieved from Angelone.in: https://www.angelone.in/knowledge-center/cryptocurrency/what-is-tokenomics-explained-tokenomics-101

Charles Schwab. (2021, February 9). Stock Analysis Using the P/E Ratio. Retrieved from Schwab.com: https://www.schwab.com/learn/story/stock-analysis-using-pe-ratio

EMBroker.com. (2022, September 7). ICO vs STO: What’s the difference? Retrieved from EMBroker.com: https://www.embroker.com/blog/ico-vs-sto/

Fidelity Learning Center. (2023, 05 16). Investing in IPOs and other equity new issue offerings. Retrieved from Fidelity.com: https://www.fidelity.com/learning-center/trading-investing/trading/investing-in-ipos#:~:text=When%20a%20private%20company%20first,private%20ownership%20to%20public%20ownership.

Hicks, C. (2023, March 15). Different Types of Cryptocurrencies. Retrieved from Forbes Advisor: https://www.forbes.com/advisor/investing/cryptocurrency/different-types-of-cryptocurrencies/

Lawson, C. (2023, January 6). Pre-IPO Cheat Codes. Retrieved from Crowdability.com: https://www.crowdability.com/cheatcode/transcript

LCX Team. (2022, April 5). What is an IDO in Crypto: IDO vs IEO vs ICO. Retrieved from LCX.com: https://www.lcx.com/what-is-an-ido-in-crypto-ido-vs-ieo-vs-ico/#:~:text=What%20is%20an%20IDO%20(Initial,via%20which%20they%20are%20launched.

McGowan, E. (2017, October 9). What Are the Stages of a Startup? Retrieved from Startups.com: https://www.startups.com/library/expert-advice/startup-stages

Noonan, K. (2022, November 30). What Is the Greater Fool Theory? Retrieved from The Motley Fool: https://www.fool.com/investing/how-to-invest/greater-fool-theory/

CuBit™ incorporates inherent protections against volatility and Universal Real Estate Wealth Protection Solutions, LLC™ (UREWPS™, the Company) is committed to supporting the asset-based valuation of CuBit™. As with any currency there is nothing to prevent speculators from taking unforeseen actions which might cause the price of CuBit™ to vary without reference to the underlying value proposition. The Company cannot prevent and is not responsible for the actions or results of such speculative behaviors.